PayPal vs Stripe: Which Payment Tool Is Best for Freelancers?

Riten Debnath

18 Jun, 2025

Choosing between PayPal and Stripe can make a big difference in your freelance cash flow. Both are trusted by millions, but which one gives you faster payments, lower fees, and happier clients in 2025? Let’s break down the pros, cons, and real costs to help you decide.

I’m Riten, founder of Fueler a platform that helps freelancers and professionals get hired through their work samples. In this article, I’ll compare PayPal and Stripe for freelancers in 2025, using the latest fee structures and practical scenarios. But remember, beyond payment tools, your portfolio isn’t just a collection of projects—it’s your proof of skill, your credibility, and your shortcut to trust. A strong portfolio on Fueler helps you attract better clients who pay on time and value your work.

Why Picking the Right Payment Tool Matters for Freelancers

Freelancers need payment tools that are fast, secure, and affordable. High fees or slow transfers can eat into your earnings and frustrate clients. The right platform helps you avoid payment delays, reduce costs, and look professional—making it easier to grow your business and focus on your craft.

PayPal for Freelancers

PayPal is a global payment platform trusted by clients and businesses in over 200 countries. Freelancers can send invoices, accept payments in many currencies, and access funds instantly. The platform provides buyer and seller protection, integrates with accounting tools, and is easy to use for both you and your clients. However, international fees and currency conversion markups can be higher than some alternatives, so it’s best for those who value convenience and global reach. The mobile app and instant transfer options make PayPal a flexible choice for freelancers.

2025 Fees:

- Domestic: 2.99% per transaction (standard online), 3.49% + $0.49 (PayPal Checkout)

- International: 4.4% + fixed fee (varies by currency)

- Currency conversion: 3-4% above base exchange rate

- ACH/E-checks: 3.49% + $0.49 (up to $300 cap)

- Chargeback fee: $15-$20

- Invoicing: $14.99/month (optional for advanced features)

Pros:

- Global reach and instant transfers make it easy to work with clients anywhere

- User-friendly interface and strong client trust

- Buyer and seller protection for added security

- Automated compliance for freelancers in countries like India

Cons:

- Higher fees for international and currency conversion transactions

- Pricing can get complicated with add-ons and advanced features

- Account holds and disputes may delay access to funds

Stripe for Freelancers

Stripe is a modern, developer-friendly payment processor that’s popular with freelancers and online businesses. It supports over 135 currencies, accepts credit cards, ACH, and digital wallets, and offers customizable checkout. Stripe’s dashboard gives you real-time analytics, advanced reporting, and automation for recurring payments. Fees are lower for international and currency conversion payments compared to PayPal. While setup may require more technical steps, Stripe’s flexibility and automation make it a top choice for freelancers who want to scale and save on fees.

2025 Fees:

- Domestic: 2.9% + $0.30 per transaction

- International: 4.3% (on international cards)

- Currency conversion: 2% markup over mid-market rate

- ACH: 0.8% (up to $5 cap)

- Chargeback fee: $15

- Invoicing: 0.4%-0.7% per invoice (Stripe invoicing)

Pros:

- Transparent, easy-to-understand pricing with no hidden fees

- Lower fees for international and currency conversion payments

- Highly customizable checkout and invoicing options

- Fast payouts and advanced automation for recurring payments

Cons:

- Slightly more technical setup, especially for non-developers

- Manual compliance steps required in some countries

- No built-in FIRA for Indian freelancers

Stripe vs PayPal: A Clear Comparison of Fees, Speed, and Flexibility for Businesses

1. Transaction Fees

Domestic Transactions:

- PayPal: 2.99% or 3.49% + $0.49

- Stripe: 2.9% + $0.30

International Transactions:

- PayPal: 4.4% + fixed fee

- Stripe: 4.3%

2. Currency Conversion

- PayPal: 3% to 4% markup on exchange rate

- Stripe: 2% markup

3. ACH / E-check Fees

- PayPal: 3.49% + $0.49

- Stripe: 0.8% per transaction (capped at $5)

4. Chargeback Fees

- PayPal: $15 to $20

- Stripe: $15

5. Invoicing

- PayPal: Optional invoicing tool at $14.99/month

- Stripe: 0.4% to 0.7% per invoice

6. Instant Access to Funds

- PayPal: Available with 1.5% fee

- Stripe: Available with 1.5% fee

7. FIRA Support (India)

- PayPal: Yes

- Stripe: No

8. Setup and Ease of Use

- PayPal: Very easy, beginner-friendly

- Stripe: Easy but requires some technical understanding

Overview:-

Stripe generally wins on lower fees for international payments and currency conversion, while PayPal offers more automation for compliance and is easier for clients who already use it. For freelancers who want to maximize earnings and flexibility, Stripe is often the better choice, especially for global work. For those who value simplicity and instant access, PayPal is still a strong option.

Fueler: Power Up Your Payment Process

Fueler, while not a payment processor, helps you get paid faster by making your work stand out. With an assignment-based portfolio on Fueler, you can show real results, build trust with clients, and justify your rates. This leads to smoother payment conversations and helps you win more projects with clients who value your skills.

Final Thoughts

In 2025, both PayPal and Stripe are excellent choices for freelancers, but your best option depends on your clients, workflow, and payment needs. Stripe is usually more affordable for international work and offers advanced automation, while PayPal is easier for quick setup and instant access to funds. Many freelancers use both to keep clients happy and minimize fees. And remember—no matter which tool you choose, a strong portfolio on Fueler will help you attract clients who pay on time, every time.

FAQs

1. Which is cheaper for freelancers: PayPal or Stripe?

Stripe usually has lower fees for international payments and currency conversion, while PayPal can be more expensive for cross-border transactions.

2. Can I use both PayPal and Stripe as a freelancer?

Yes, many freelancers use both to give clients more options and minimize fees.

3. Which payment tool is faster for withdrawals?

Both offer instant payouts for a 1.5% fee, but PayPal allows instant access to your PayPal balance.

4. What’s the best payment tool for Indian freelancers?

PayPal offers automated compliance (FIRA) and quick withdrawals to Indian banks, while Stripe is invite-only and requires manual steps for compliance.

5. How can I make my payment process more professional?

Use Fueler to showcase your work, set clear payment terms in your contracts, and choose payment tools that offer fast, secure, and affordable transfers.

What is Fueler Portfolio?

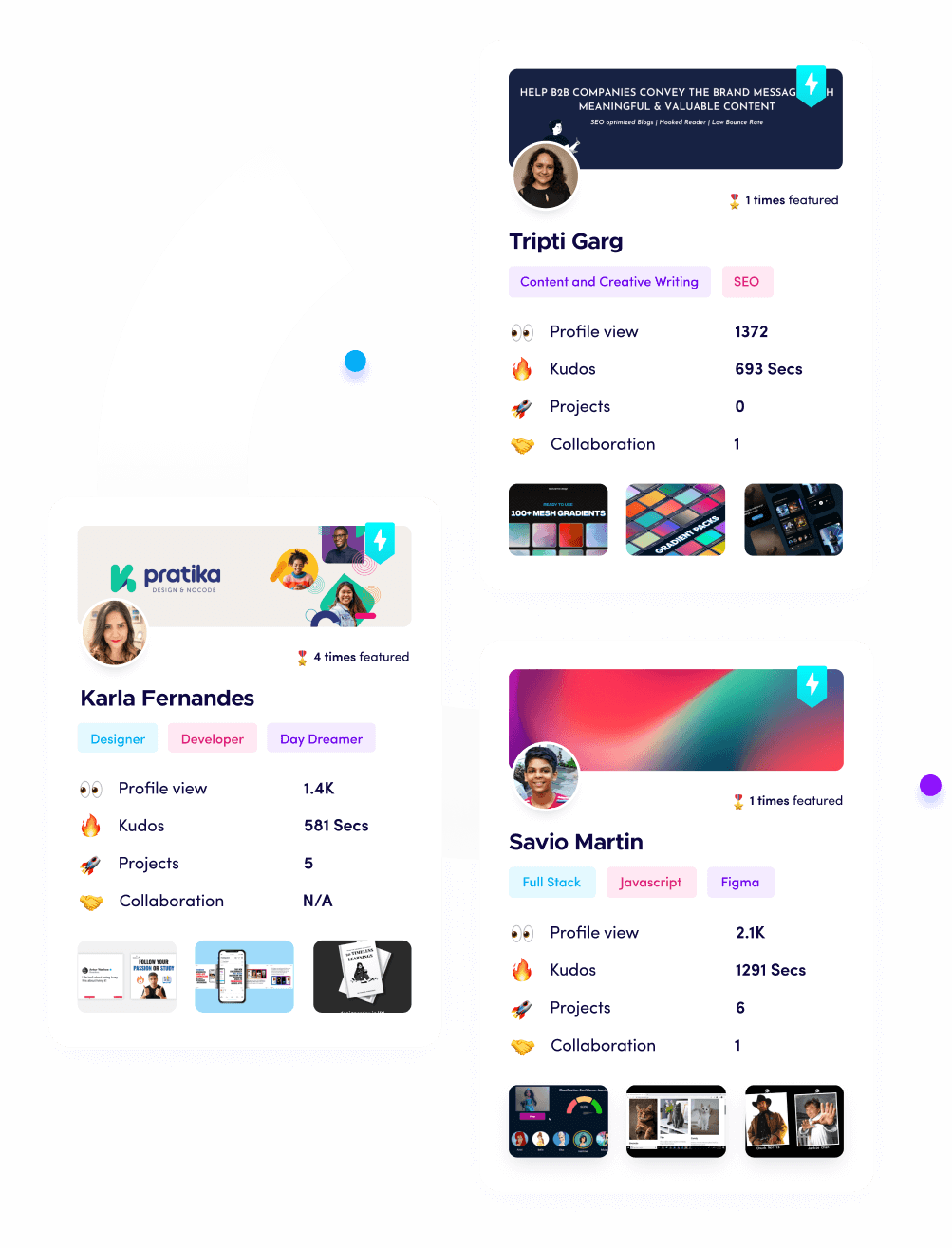

Fueler is a career portfolio platform that helps companies find the best talents for their organization based on their proof of work.

You can create your portfolio on Fueler, thousands of freelancers around the world use Fueler to create their professional-looking portfolios and become financially independent. Discover inspiration for your portfolio

Sign up for free on Fueler or get in touch to learn more.